Purpose of this calculator

The purpose of this calculator is to provide you with a reasonable estimate of the life insurance cover: Life, Total and Permanent Disability (TPD), Trauma and Income Protection (IP), amounts that you may want to consider when purchasing insurance.

The calculations are based on the information supplied by you, does take into consideration all of your personal circumstances and situation, and should be not be relied on as sole basis when making a decision as to how much insurance should be purchased. You may want to seek further professional financial advice before deciding what cover amounts and which products to purchase. It is also important to read the Product Disclosure Statement for the relevant insurance product (links supplied on the home page) before proceeding with your purchase to ensure the product is suited to your circumstances, needs, objectives and requirements

After purchasing a life insurance product, you may also want to review your cover as your life circumstances change, for example, if your family grows, you buy a new home or you get married. This is to ensure that you and your family have adequate cover should an the unexpected event e.g. sickness or illness, were to occur. We suggest you review your insurance cover at least yearly if not every second year to make sure it is appropriate for your current circumstances.

What is the ‘Ideal’ amount of insurance?

What we know is that most people do not have an appropriate level of cover. Up to 80% of Australians do not have an appropriate lever of personal insurance cover in place – we call this being underinsured. This is due in part to affordability or or cash flow constraints. The insurance industry would like everyone to have an ‘ideal’ amount of insurance whereas we understand that most people only have what they can afford – the ‘real’ amount. Often we find the two shall never meet…what is ‘ideal’ and what is ‘real’. Never-the-less, it is important to understand how much insurance you should, then decide how much you can afford, and finally do something about it e.g. take out some insurance.

How much insurance should you have?

Whilst the amount of personal insurance cover can vary amongst individuals, there is a general consensus amongst financial advisors as to how to calculate the amount of insurance cover you should have in place.

Income Protection

- Income: For Income Protection it is simply a percentage of your salary, normally 70% of ‘income’. After 1st October 2021, APRA, who regulates those companies who manufacture and distribute insurance products, made some major changes to Income Protection. The major changes will see many insurers only offering 70% of ‘income’ for the first 2 years and then this will be reduced down to either 60% thereafter with some reducing it down to 40%. History has shown that 97% of people who put in an IP claim are on claim for less than 2 years or less. As such, they believe it is fairer to make it cheaper for those taking out benefit periods of 5 years or less compared to those wanting benefit periods greater than 5 years.

Life, TPD & Trauma

When it comes to Life, TPD and Trauma cover and the amounts you should have, you must take into account six (6) key factors. These six (6) factors are:

- Debts (Life | TPD | Trauma) : Any type of personal debts you have e.g. mortgage, credit card, personal loans, should be paid out in the event that you become ill or injured.

- Education Costs (Life | TPD | Trauma) : If you wish to send your children to private schooling then an appropriate amount for future education costs should be accounted for. You will be provided the opportunity to enter in the ‘average’ cost of your child’s schooling fees.We work on the assumption that most children will complete Year 12 by age 19 and attend at least 12 years of schooling.

- Medical Costs (TPD | Trauma) : If you suffer a TPD event or Trauma, you may incur immediate and ongoing medical costs for which most health insurances and public hospitals will not cover. Based on research we have performed, we believe an appropriate amount of Medical costs would be $150,000.

- Taxation (TPD): Whilst we cannot provide tax advice and recommend you seek advice from your accountant and/or tax agent, we must make you aware that if TPD is held in super then you will most likely pay tax on any TPD monies paid from your superannuation fund. For Trauma payments, there is no tax payable and with Life insurance, if the payment is made to a partner/spouse or ‘tax dependent’, in most cases, no tax is payable. Tax will most likely be payable if the proceeds are paid out to a non-tax dependent person. Again, it is important to seek tax advice in relation to personal insurance payments to make sure you have adequate cover in place. For now, we will simply add 22.5% tax to your TPD as we will assume that most, if not all, of your TPD will be held in a super environment.

- Replacement Income (Life | TPD): This is the hardest one to determine and it first of all depends on whether or not you have Income Protection in place. If you have IP in place then we only take into account 25% of the income that needs to be replaced. If however, you do not have income in place we have to take into account 100% of replacement income. We calculate replacement income as follows: How many years until you reach age 67 (age pension age) X Annual Salary X 2/3. Why 2/3? We anticipate you will invest your lump sum replacement income and your investment will grow over time. As such, it will take longer to reduce the capital when drawing down an income.

- Other (Life | TPD): For Life insurance we simply take into account a small amount e.g. $15,000 for funeral expenses. For TPD, we include another $200,000 for costs associated with modifying the home and/or purchasing a new vehicle to allow wheelchair access. Research has shown that if someone becomes a paraplegic or quadriplegic, the initial and ongoing costs amount to $1.1 M and $4 M , respectively.

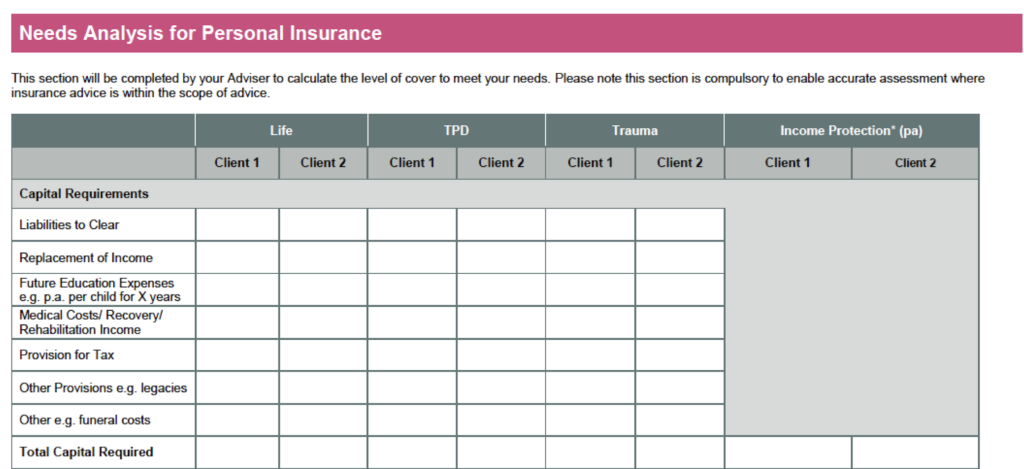

Needs Analysis Form

Most financial planners, when calculating how much insurance you should have in place, will use a Needs Analysis Form. We have provided an example of Needs Analysis form for you to refer to below. You may like to print it off and use this form when working out your amount of cover.

Assumptions

- The cover amounts provided assume that your occupation and age allow you to purchase that cover.

- The trauma cover default amount used in the calculator is $150,000, which has been calculated based on the three trauma events most likely to occur and taking the highest claim amount of all three, which is the event of stroke at $150,000.

Costs for the most likely trauma events are:

| Event | Individual Lifetime Costs | Source | Notes |

|---|---|---|---|

| Heart Attack | $20,000 | Australian Institute of Health and Welfare publication Health System Costs of Cardiovascular Disease in Australia 1993-94 | Figure has been adjusted to account for inflation |

| Cancer | $120,000 | i. Australian Institute of Health & Welfare, Health System Expenditures on Cancer in Australia 2000 — 2001, Published May 2005.ii. Optimising Cancer Care in Australia, National Cancer Control Initiative, February 2003.iii. Access Economics — Cost of Cancer in NSW, April 2007). | Figure has been adjusted to account for inflation |

| Stroke | $150,000 | Lifetime costs of stroke subtypes in Australia, Melbourne, June 2003. | Figure has been adjusted to account for inflation |

Limitations

- Income, mortgage and debt amounts that can be entered are restricted to the options and ranges provided by the calculator.

- The maximum number of children used in this calculation is limited to 10.

- Your available insurance options may be limited by eligibility after underwriting, your age, your occupation and other factors.

Disclaimers

- The output provided by this calculator is general information only and should only be used as a guide to help you compare your insurance options through Find Insurance.

- All insurance cover is subject to eligibility and the outputs provided by the calculator are not guaranteed, nor an indication of the acceptance of these cover options, and could be changed during the underwriting process.

- This calculator can only provide you with an estimate based on the information that you provide and should not be relied on when making a decision on what cover amount you should choose or which insurance product you should purchase.

- You may want to consider the future costs of living if you have decided not to increase your cover amounts in line with inflation.

- To the maximum extent permitted by law, neither Find Wealth Pty Ltd T/as Find Insurance nor any of its related bodies, employees or agents (within the ClearView Financial Advice Pty Ltd Licensee) warrants the accuracy or reliability of the calculator. Find Insurance, and its related bodies, disclaim all liability to the maximum extent permitted by the law, to any person in respect of anything done or omitted to be done, and the consequences of such action or omission, by any such person in reliance upon all or any part of the information obtained using the calculator.

- Before using the information provided by this calculator, you should review the cover amounts and options, and seek further advice to understand their suitability before proceeding.

This is current as of 1st October 2021